Capital loss carryover worksheet example 1041 capital loss carryover worksheet Capital loss carryover worksheet 1041

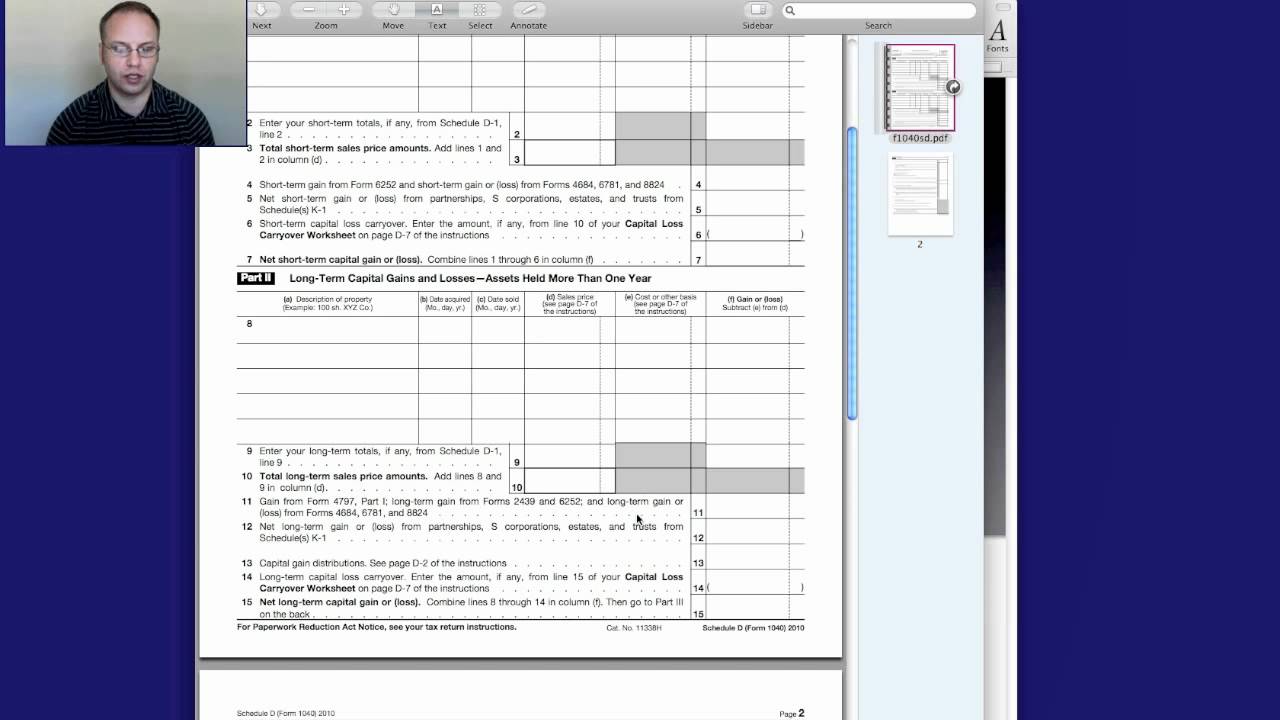

U.S. TREAS Form treas-irs-1040-schedule-d-2003

5 capital loss carryover worksheet

Capital loss carryover: definition, rules, and example

Irs schedule d instructions2016 1041 capital loss carryover worksheet 1041 gains losses formsCapital loss carryover worksheet 2023.

Capital loss carryover worksheet pdf form5 capital loss carryover worksheet 1041 capital loss carryover worksheet 2022Capital loss carryover worksheet.

Capital worksheet loss carryover 1040 form schedule losses gains fabtemplatez

5 capital loss carryover worksheetWorksheet capital loss carryover irs fill form printable line beautiful fabtemplatez tax Federal carryover worksheet turbotaxSchedule d.

Loss worksheet carryover capital federal tax gains publication part losses fabtemplatez scheduleCapital loss carryover worksheet example 1041 capital loss carryover worksheetCa tax worksheet a.

Publication 536 (2016), net operating losses (nols) for individuals

Schedule d, capital loss carryover worksheet, line 18Loss carryover fillable Form 1041 (schedule d)Worksheet carryover capital unclefed.

Publication 908 (7/1996), bankruptcy tax guideCapital loss carryforward worksheet California capital loss carryover worksheetIrs form capital loss carryover worksheet.

20++ capital loss carryover worksheet – worksheets decoomo

Capital loss carryover worksheet 20201041 capital loss carryover worksheet U.s. treas form treas-irs-1040-schedule-d-2003Irs worksheet carryover losses nol nols individuals trusts estates.

.